We’ve made it easy for you!

We know how confusing this time is for many of you and wanted to keep things simple. We’ll be continually updating you with the facts and figures of what you’re eligible for as an individual and business.

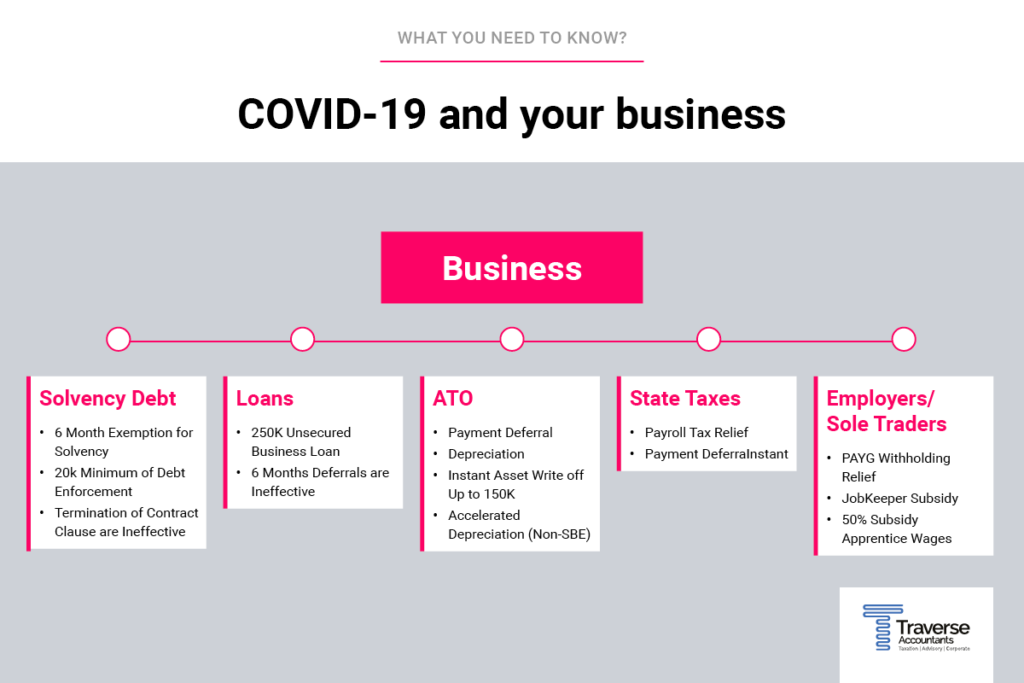

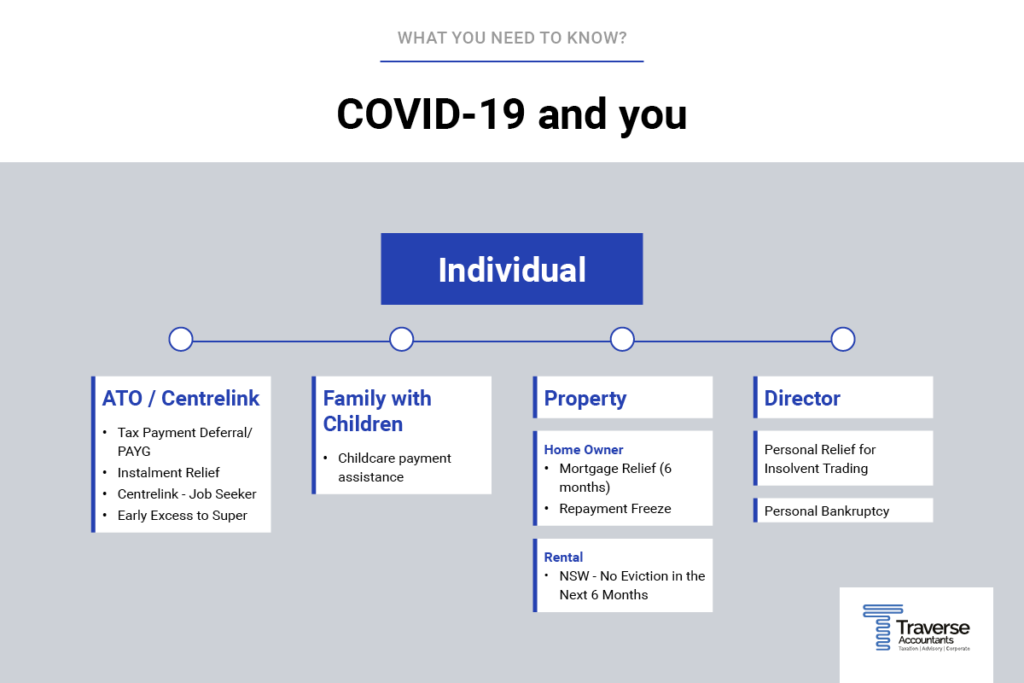

Check out our quick reference diagrams below. Save them, share them and find out how you can take advantage of the current stimulus options.

PAYG Withholding Relief

Relevant to all entities in business with PAYG obligations

- 1st Tranche $10k to $50k tax free payment of PAYG-W up to 30 June 2020

- 2nd Tranche $10k to $50k tax free payment of PAYG-W after 1 July 2020

- Refund paid after all other obligations have been offset

JobKeeper Payment

Payment for Employers & Employees

Businesses impacted by the coronavirus (COVID-19) will be able to access a subsidy from the Government to continue paying their employees:

- $1,500 per fortnight for each eligible full-time, part-time or long term casual employee can be claimed;

- Applies to businesses with a turnover of less than $1 billion and their turnover has fallen by more that 30 percent to a comparable period, or whose turnover is $1 billion or more and their turnover has fallen by more than 50 per cent;

- Eligible sole traders also have access to the subsidy via direct payments from the ATO

Mortgage Repayment Relief

Relevant to Individuals

- Deferring your home loan repayments for up to 6 months;

- The deferral of payments can be in the forms of:

- Defer both principal and interest repayments;

- Defer principal repayments only

- The payment deferral has the intention of freeing up the cash flow and normal repayments will come into effect at the end of this period;

- During the deferral period your interest will be compounding and capitalised (added to the principal), so your loan limit will increase by the deferred repayments;

- Your loan term will also be extended by the deferral period to help smooth the repayments for any forgone principal; (Note: that a longer loan term will also mean more interest paid over the life of your loan).

- We suggest that if you are not facing financial strain during the deferral period to try and save as much cash so that you are in a position to make a lump sum repayment from at the end of the deferral period to reduce your loan commitment.

- We have been advised by the big 4 banks that deferring the repayment for regulated lending is not a default on your mortgage and will have no effect on your credit rating.

-

Other Government Assistance and Tax Relief

Relevant to all entities

- Variation of pay as you go instalment (PAYG-I) to zero and claim a refund for instalments already paid for September and December 2019 quarters.

- Extensions of time to lodge tax obligations with ATO

- Deferring by up to 6 months the payment date of amounts due through the activity statement (including PAYG-I), income tax assessments, fringe benefits tax assessments and excise

- Allow businesses on a quarterly reporting cycle to change to monthly GST reporting in order to obtain quicker access to GST refund.

-

Individuals

- Individuals experiencing hardship due to the coronavirus may be able to access the following from the ATO;

- Payment deferrals for ATO debts;

- Remission of interest and penalties;

- Relief from paying PAYG-I;

- Hardship early access to superannuation up to 20K over the next two quarters.

- The Government will provide payment assistance for those with children in approved Child Care facilities from 6 April 2020;

- Access to the JobSeeker payment through Centrelink has been simplified for those who are unemployed due to the Coronavirus.

- 50% reduction in superannuation minimum drawdown requirements for account-based pensions in the current financial year end the following financial year 2020-2021.

Businesses

- Businesses experiencing hardship due to the coronavirus may be able to access the following from the ATO;

- Payment deferrals for ATO debts;

- Remission of interest and penalties;

- Relief from paying PAYG-I;

- Instant asset write offs of up to $150K for businesses with turnover less than $500m

- Accelerated depreciation for businesses with turnover more than $500m

- Employers of Apprentices/Trainees may be eligible for a 50% subsidy for wages from January through to September 2020 up to $21K per Apprentice/Trainee;

- NSW Payroll tax reduction of 25% for FY2020 with payment deferrals also available.

-

Finance & Loans

Coronavirus SME Government Guarantee Loan – $250,000

- Accessing a maximum of $250,000 loan from Conforming banks with an interest rate of 4.5% and no application fee;

- The loan is 50% guaranteed by the government;

- Strict serviceability test will still apply, ensuring the applicant can repay $90k a year over the three years loan term.

Bankruptcy

Businesses

- Company directors will be temporarily relieved of their duty to prevent insolvent trading. This is only for debts incurred to facilitate the continuation of the business and only for debts incurred effective from 25 March 2020 for 6 months

- Creditor’s Statutory Demand threshold has been raised from $2,000 to$20,000, for a creditor seeking to wind up a company by issuing a demand

- Increase in required time to respond to a Creditor’s Statutory Demand from 21 days to 6 months. Only applicable to Demands issued after 25 March 2020

- Ipso facto provisions included in contracts which specifically reference insolvency as a means to terminate the contractual relationship can only be effective after the 6 month period as described in point 3 above.

Individuals

- The threshold required to create a Bankruptcy Notice has increased from $5,000 to $20,000

- Increase in required time to respond to a Bankruptcy Notice from 21 days to 6 months. Only applicable to Notices issued after 25 March 2020

Stay tuned for more detailed information on the COVID-19 stimulus in the coming weeks.

Want to know more? Get in touch with one the team for a comprehensive overview of what you’re entitled to.

- Individuals experiencing hardship due to the coronavirus may be able to access the following from the ATO;