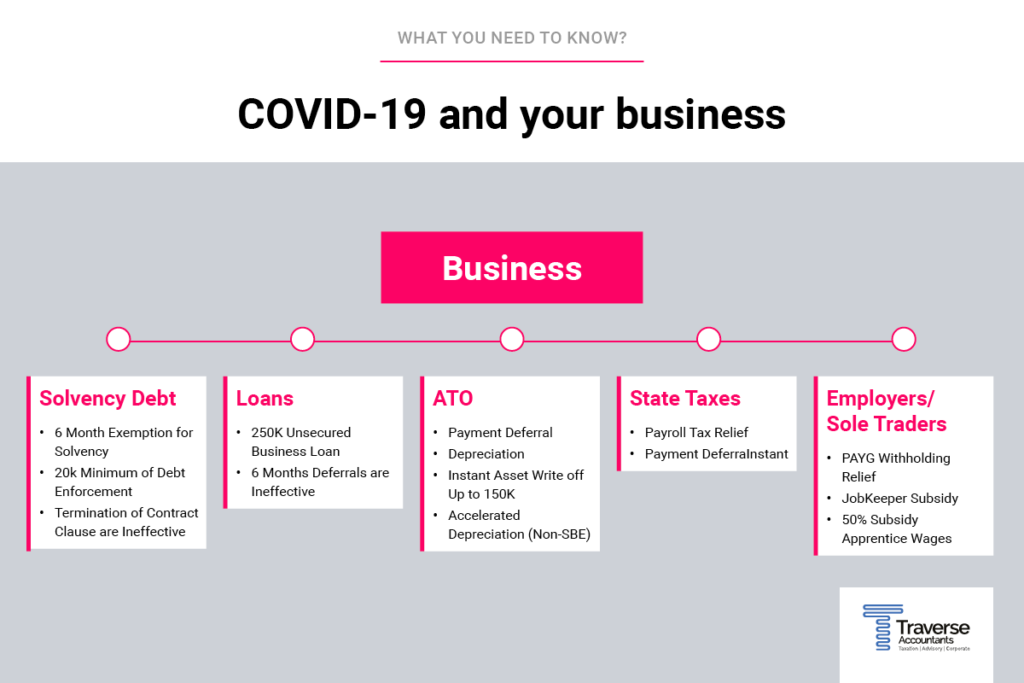

Overview

Relevant to all entities in business with PAYG-W obligations

- 1st Tranche $10k to $50k tax free payment of PAYG-W up to 30 June 2020;

- 2nd Tranche $10k to $50k tax free payment of PAYG-W after 1 July 2020;

- Refund paid after all other ATO obligations have been offset.

1st Tranche $10k to $50k free payment

Reportable in March 2020 BAS, receivable from 28 April 2020

- Entity requirements (sole trader, trust, partnership, company)

- Less than $50 million turnover;

- Held an ABN on 12 March 2020; and

- Carrying on a business and earned assessable income in FY 2019;

- OR

- Made supplies in course or furtherance of an enterprise starting 1 July 2018 and ending before 12 March 2020 (new businesses are therefore included).

- Payment based on 100% of PAYG-W in activity statements from January to June 2020 with monthly PAYG lodgers receiving 300% of the PAYG-W reported in the March 2020 BAS and the credit will be made be available after 28 April 2020 with the net refund after GST obligations paid within 14 days.

2nd Tranche $10k to $50k free payment

Reportable in July to October 2020 activity statements, receivable within 14 days of lodgement

- Requirements are the same as from Tranche 1 and business continues to be active;

- Additional payment equal to 100% of PAYG-W amount in Tranche 1, paid in activity statement from July to October 2020.

Stay tuned for more detailed information on the COVID-19 stimulus in the coming weeks.

Want to know more? Get in touch with one the team for a comprehensive overview of what you’re entitled to.