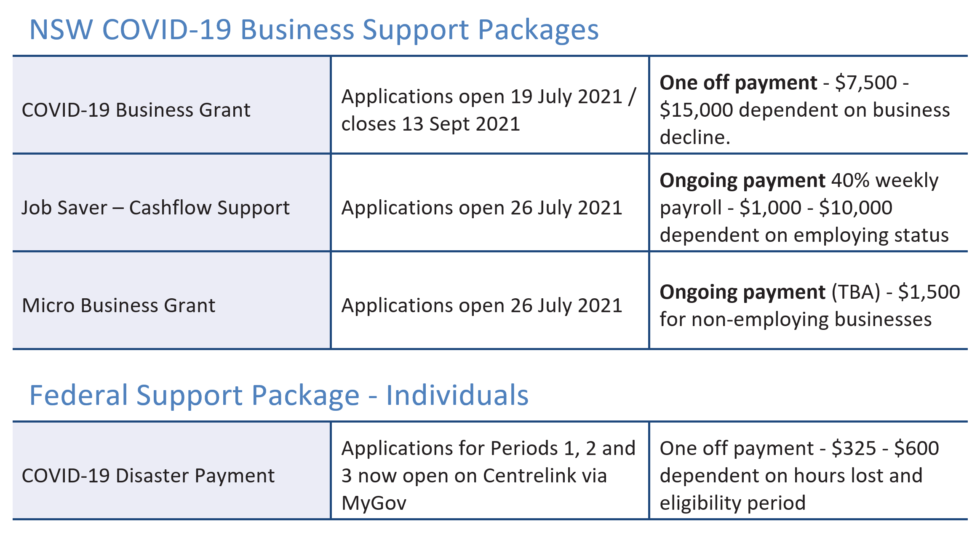

The NSW Government is offering financial support to businesses impacted by the recent COVID-19 restrictions and stay-at-home orders.

If your business or not-for-profit organisation has been impacted by the restrictions, you may be eligible to apply.

COVID-19 business grant

If you’re a business, sole trader or not-for-profit organisation impacted by the current Greater Sydney COVID-19 restrictions, you may be able to apply for a grant of up to $15,000 from 19 July 2021. The grant can be used for business expenses such as rent, utilities and wages, for which no other government support is available.

Three different grant amounts will be available depending on the decline in turnover experienced during the restrictions:

- $7,500 for a decline of 30% or more

- $10,500 for a decline of 50% or more

- $15,000 for a decline of 70% or more.

To be eligible for the grant you must demonstrate your business has experienced a decline in turnover of at least 30% over a minimum 2-week period between 26 June 2021 and 17 July 2021 compared to the same period in 2019.

Cashflow support – Job Saver

From week four of the lockdown, the Commonwealth will fund 50 per cent of the cost of a new small and medium business support payment to be implemented and administered by Service NSW.

Eligible entities will receive 40 per cent of their NSW payroll payments, at a minimum of $1000 and a maximum of $10,000 per week.

Entities will be eligible if their turnover is 30 per cent lower than an equivalent two week period in 2019.

The new small to medium business support payment will be available to non-employing and employing entities in NSW, including not for profits, with an annual turnover between $75,000 and $50 million.

To receive the payment, entities will be required to maintain their full time, part time and long term casual staffing level as of 13 July 2021.?

For non-employing businesses, such as sole traders, the payment will be set at $1,000 per week.

Micro Business Grant

If you’re a micro business (small business or sole trader with annual turnover of more than $30,000 and under $75,000) impacted by the current Greater Sydney COVID-19 restrictions, you may be able to apply for a $1,500 payment per fortnight of restrictions from late July 2021.

What to do next

The above grants will be administered by Service NSW. Traverse recommends you take the following steps to ensure you are ready to meet eligibility criteria and process potential claims:

- Ensure BAS and accounting records are up to date

- ensure your business and contact details are up-to-date with the Australian Business Register (ABR)

- ensure your personal, contact and business details are up-to-date in your MyServiceNSW Account and your business profile.

- if you don’t have one, create a MyServiceNSW Account and business profile.

We are here to help

Please contact your Traverse Advisor should you require assistance in your application for any of the above grants.