Coronavirus SME Government Loan Guarantee – $250,000

The Coronavirus Small and Medium Enterprise (SME) Guarantee Scheme is a coordinated action between the Australian lenders and Federal Government to support the flow of credit in the Australian economy by supporting the small and medium-sized business with an unsecured loan up to $250,000 for a business who is impacted by COVID-19.

Key information

- The maximum amount is $250,000 with 50% guaranteed by the Australian Government;

- No establishment or account fees;

- Interest rate dependent upon customer risk-grade – refer to the specific lender; and

- The term is three years – first 6-month repayment deferred and interest capitalised.

Eligibility

- Loans must be used to support current, and upcoming business cash flow needs only, including working capital, liquidity and operating expenditure and cannot be used to refinance drawn facilities.

- Meets the small and medium business turnover test with less than $50M in gross revenue;

- The government expects lenders to follow their USUAL credit assessment process, and to look through the cycle to sensibly take into account the uncertainty of the current economic conditions

Example

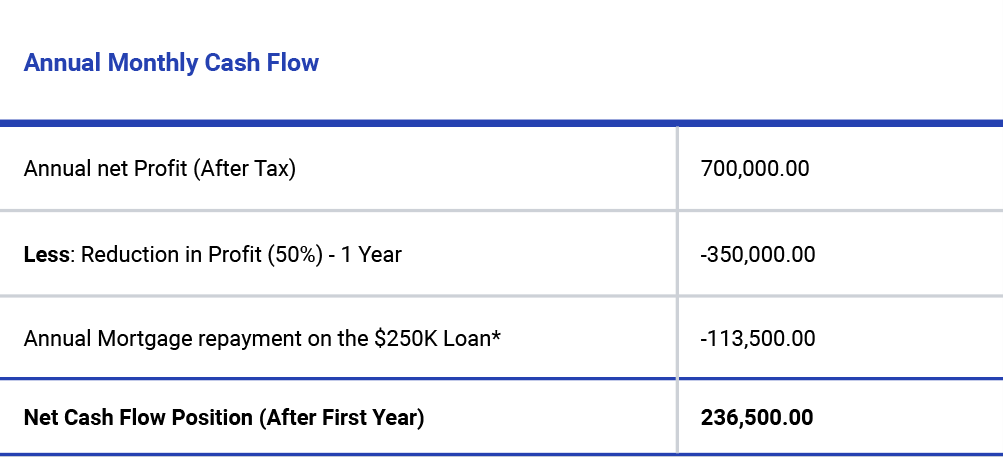

Bianca is a childcare operator with a historical annual turnover of $2m a year with an average net profit after tax of $700K per annum. Her business is severely impacted by COVID-19 and expects a 50% drop in revenue for a year. She worked with her Accountant and prepared an annual cash flow to assess her ability to repay the loan with a 50% drop in revenue for the first year.

Stay tuned for more detailed information on the COVID-19 stimulus in the coming weeks.

Want to know more? Get in touch with one of the team for a comprehensive overview of what you’re entitled to.

Stay tuned for more detailed information on the COVID-19 stimulus in the coming weeks.

Want to know more? Get in touch with one of the team for a comprehensive overview of what you’re entitled to.