Overview

Relevant to employers and employees

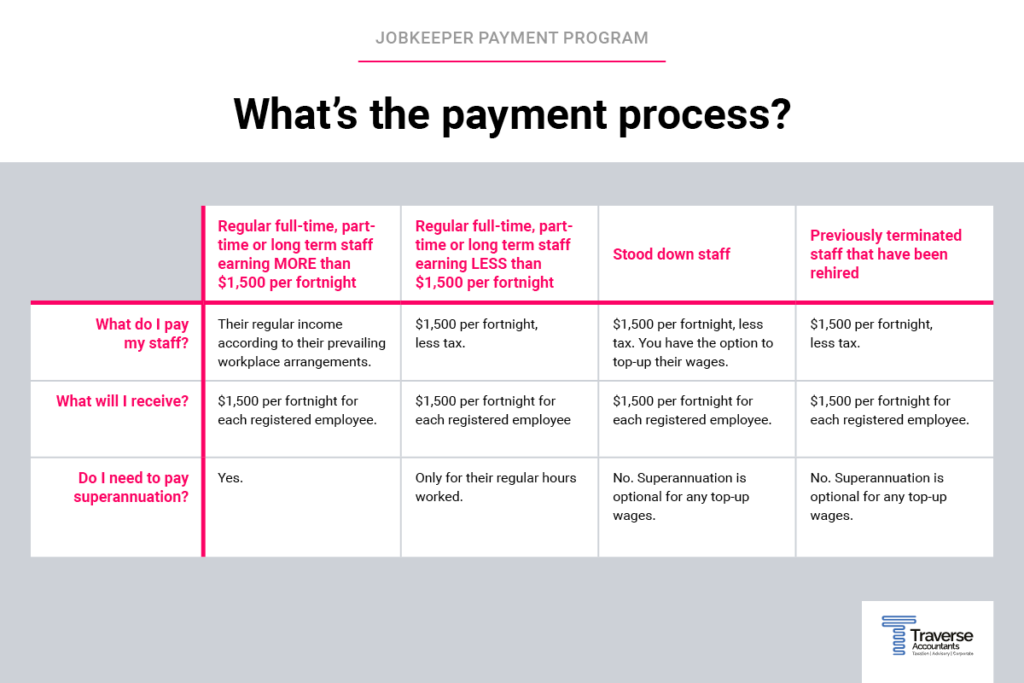

- Under the JobKeeper Payment, businesses impacted by the coronavirus (COVID-19) will be able to access a subsidy from the Government to continue paying their employees;

- Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months;

- The payment will be made in respect of employees who were on the books at 1 March 2020, have been retained and continue to be engaged by the employer;

- Full time, part-time, and long-term casual employees, including stood down employees will be eligible to receive the JobKeeper payment;

- If a staff member has been terminated since 1 March 2020, the employer is able to reinstate them and register them for the JobKeeper payment, subject to eligibility requirements.

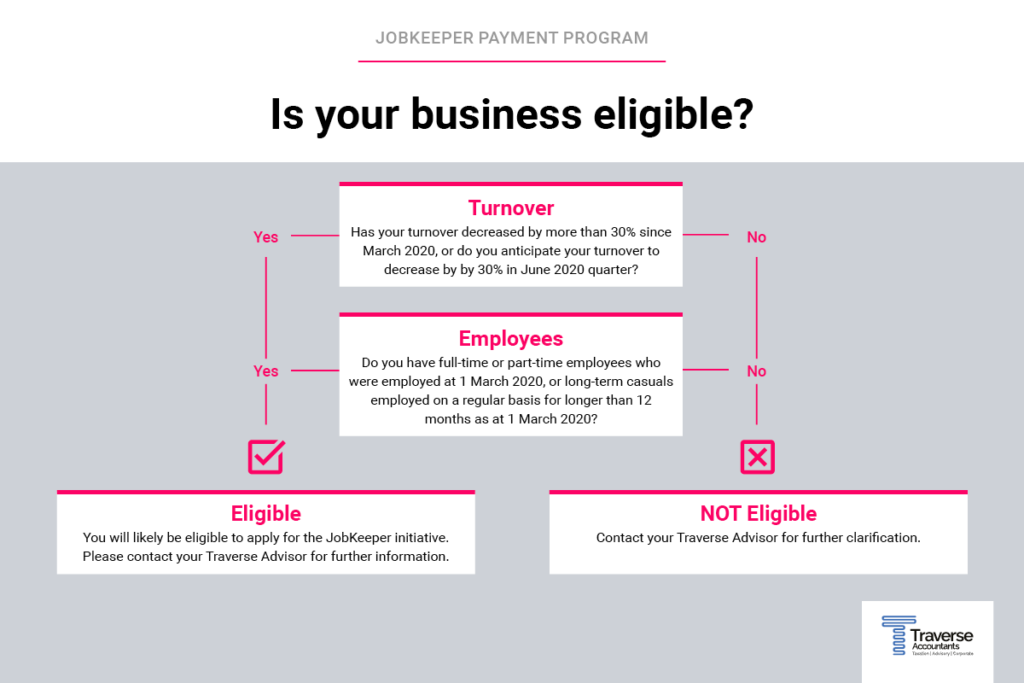

Eligible employers

- Eligible employers include companies, partnerships, trusts, sole traders and not for profit entities including charities;

- Businesses with a turnover of less than $1 billion and their turnover has fallen by more than 30 per cent (of at least a month);

- Businesses with a turnover of $1 billion or more and their turnover has fallen by more than 50 per cent (of at least a month);

- The reduction in revenue will be tested over a minimum one month period post 1 March 2020 and will be relative to a comparative period a year ago. Monthly updates will be required to be provided to the ATO;

- The business is not subject to the Major Bank Levy.

Eligible employees

The subsidy will start on 30 March 2020. Employers can register their interest at ATO – JobKeeper Payment in order to receive regular updates from the ATO.

-

- Are at least 16 years of age;

- Are currently employed by the eligible employer (including those stood down or re-hired);

- Were employed by the employer at 1 March 2020;

- Are full-time, part-time, or long-term casuals (a casual employed on a regular basis for longer than 12 months as at 1 March 2020);

- Are an Australian citizen, the holder of a permanent visa, a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more, or a Special Category (Subclass 444) Visa Holder;

- Are not in receipt of a JobKeeper Payment from another employer.

Sole traders

-

-

- Businesses without employees, such as sole traders, will be eligible for the JobKeeper payment. These businesses will be required to provide an ABN for their business and nominate an individual to receive the payment. The business must also provide that individual’s Tax File Number and provide a declaration as to recent business activity.

-

Stay tuned for more detailed information on the COVID-19 stimulus in the coming weeks.

Want to know more? Get in touch with one the team for a comprehensive overview of what you’re entitled to.